On June 30, Zhenhai Petrochemical Construction and Safety Engineering Co., LTD. (hereinafter referred to as: Zhenhai Construction and Safety) issued an initial public offering of shares and listed on the main board prospectus (declaration draft), with CICC as the main underwriter.

According to the prospectus, Zhenhai Jian ‘an is a high-tech enterprise integrating the research and development, design, manufacturing, sales and petrochemical equipment engineering services of efficient heat exchangers, and analyzes the industry.

1、Heat exchanger industry

1)Market scale of heat exchanger industry in China

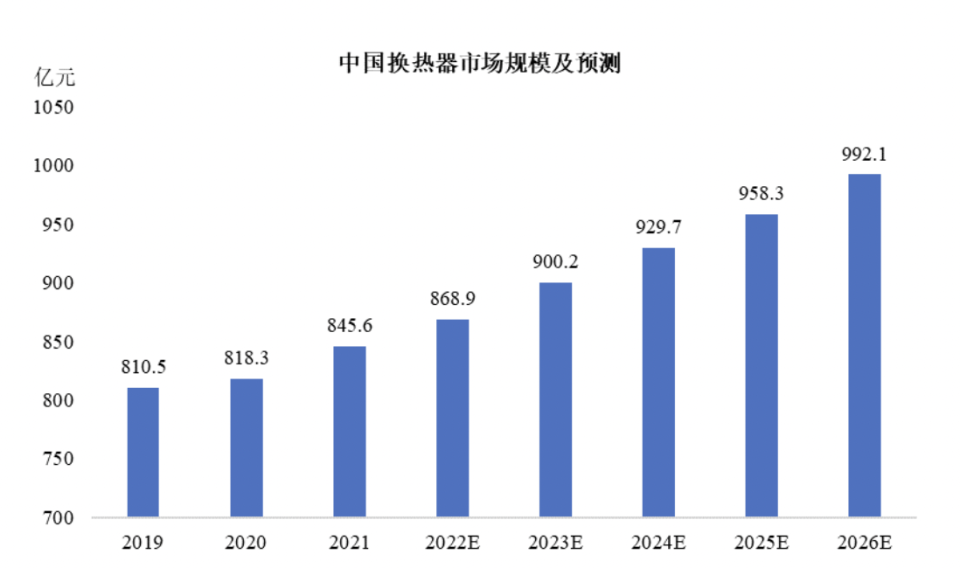

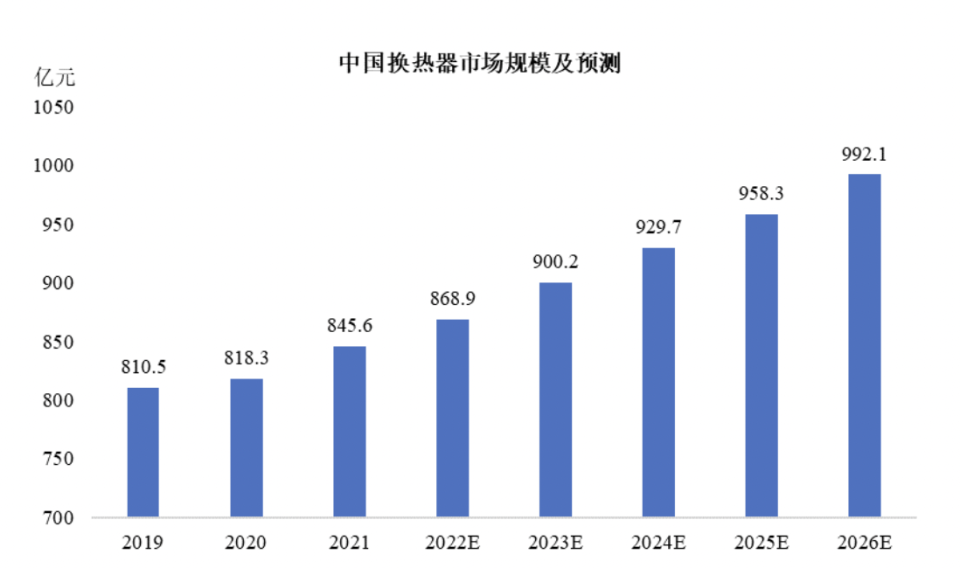

Petrochemical, coal chemical, fine chemical, etc., are the main application areas of heat exchangers, and their development has a direct impact on the market performance of heat exchangers. Since 2017, China’s refining capacity has returned to the growth track, which has played a very important role in promoting the rise in heat exchanger market demand. In 2019, the scale of China’s heat exchanger market reached 81.05 billion yuan. Heat exchangers as the basic equipment in the production process of many industries, the overall demand remains relatively stable. In 2021, the scale of China’s heat exchanger market has rebounded significantly, reaching 84.56 billion yuan.

As one of the key equipment in China’s industry, heat exchangers will still have a wide range of market demand in the future, especially in major application areas such as petrochemical industry, and there is a large room for growth and upgrading demand in the future. It is expected that from 2022 to 2026, the scale of China’s heat exchanger market will rise from 86.89 billion yuan to 99.21 billion yuan, with a compound annual growth rate of 3.4%.

2)Market scale of wound tube heat exchanger in China

As one of the largest application areas of wound tube heat exchangers, petrochemical industry has a direct impact on the demand for wound tube heat exchangers. From 2019 to 2021, China’s refining capacity has grown steadily, reaching 860 million tons, 890 million tons and 910 million tons, respectively, according to the CNPC Economic and Technological Research Institute. At the same time, driven by the demand for green and intelligent, the upgrading of refining and chemical projects has been carried out nationwide, and the demand for wound tube heat exchangers has been increasing. In the future, with a new round of large-scale refining and chemical projects have been completed and put into operation, China’s refining capacity will continue to maintain stable growth, and the relevant policies of carbon peak and carbon neutrality will promote the acceleration of refining and chemical integration transformation and upgrading, laying a solid foundation for the winding tube heat exchanger to stabilize the existing market and expand the development space.

In recent years, the energy conservation and emission reduction policy has been tightened, and the coal chemical industry is facing greater transformation pressure, which also brings opportunities for the further deepening of the application of wound tube heat exchangers. On the other hand, under the transformation of the energy structure, the proportion of coal-fired power generation will be reduced, resulting in excess coal production capacity, coal prices are expected to continue to reduce, making the coal chemical industry greatly benefit, thereby driving the development of the winding tube heat exchanger industry. At the same time, solar power generation and other fields will usher in a period of rapid development, and further expand the market space of wound tube heat exchangers.

According to Frost and Sullivan, in 2021, China’s winding tube heat exchanger market size reached 1.48 billion yuan. It is expected that from 2022 to 2026, the market size of China’s wound tube heat exchanger will increase from 1.93 billion yuan to 3.81 billion yuan, with an annual compound growth rate of 18.5%.

3)Heat exchanger industry competition pattern

After years of development, the heat exchanger industry has gradually formed a technological progress and market-oriented industry competition pattern, and many domestic and foreign excellent heat exchanger companies have launched business layout in our market. With the rapid development of the technical level of the heat exchanger industry, product performance continues to improve, and the importance of heat exchangers in various fields of the national economy continues to strengthen. From the perspective of the overall heat exchanger market, the leading foreign enterprises include the United States April heat exchanger Company, Sweden Alfa Laval, etc., and the leading domestic enterprises include Lanshi heavy loading, tin loading shares, companies and so on. As one of the new and efficient heat exchanger technology routes, the research and development and design are difficult, and the production and manufacturing process requirements are high, so the market concentration of the wound tube heat exchanger is relatively high. Frost & Sullivan statistics show that in 2021, the market share of domestic wound tube heat exchanger companies ranked first, accounting for 63.4%.

2、Petrochemical equipment engineering service industry

1)Petrochemical equipment engineering service industry market size

Petrochemical equipment engineering services are closely related to the development and investment of the petrochemical industry. At present, driven by the national energy security strategy, petrochemical enterprises actively increase storage and production and increase capital expenditure, which is conducive to maintaining the prosperity of the petrochemical equipment engineering service industry.

According to Frost & Sullivan statistics, in 2019, the overall market size of China Petrochemical equipment engineering services reached 7.81 billion yuan. At the beginning of 2020, fluctuations in the external environment had a certain impact on the production and manufacturing industries such as petroleum and chemical industry, but with the stabilization and recovery of the economy, the added value of China’s petroleum and chemical industry grew by 2.2% throughout the year, gradually showing a stable recovery trend. Since 2021, the economic structure has further improved, and the market demand for petrochemical equipment engineering services has further rebounded: In 2021, the overall market size of petrochemical equipment engineering services is 12.87 billion yuan, and petrochemical equipment transportation, inspection and maintenance, as one of the key links to improve the safety and energy-saving production of China’s petroleum and petrochemical equipment, is expected to reach 21.21 billion yuan in 2026.

2)Petrochemical equipment engineering service market competition pattern

Over the years, with the continuous development of China’s petrochemical industry, China has formed a number of petrochemical industry bases, with a large number of petrochemical enterprises and wide geographical distribution. Therefore, there are many petrochemical transportation and inspection and maintenance projects, wide professional coverage, scattered projects, and low concentration of service providers. Typical participants in the industry include the company, Guangdong Maohua Construction Group Co., LTD., Tianjin Jinbin Petrochemical Equipment Co., LTD., Shandong Qilu Petrochemical Construction Co., LTD., Beijing Yanhua Zhengbang Equipment Maintenance Co., LTD., Yueyang Changlian Electromechanical Engineering Technology Co., LTD., Sinopec Nanjing Engineering Co., LTD., Zhejiang Yuanzhuo Energy Technology Co., LTD. With the increasing requirements of large-scale petrochemical enterprises for the transportation quality and long-term operation performance of petrochemical equipment, the strong third-party petrochemical equipment engineering service enterprises have gradually increased their share in the market due to the advantages of complete professional and technical categories, outstanding transportation inspection and maintenance technology, and high project delivery quality.

Technology

Technology Products

Products Solution

Solution Information

Information About us

About us Contact us

Contact us